22 Oct, 2023

A Pragmatic Guide Into Financial Planning & Analysis and Why You Need It.

Jeroen

Founder, Startup Finance

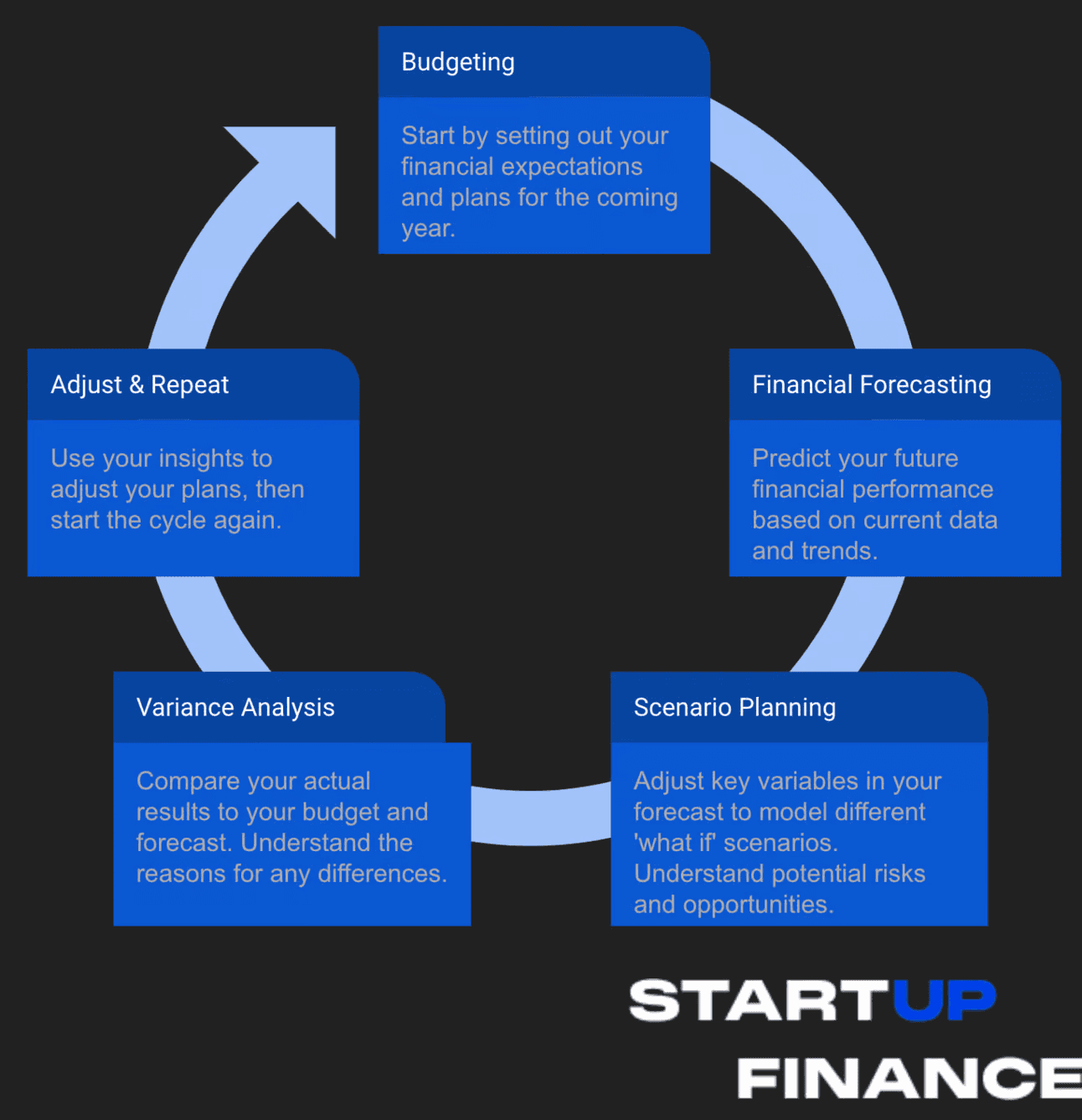

First, what is the FP&A Circle?

The FP&A Circle is a systematic approach to financial planning and analysis to make sure that an organisation’s financial strategies are aligned with its objectives and that they’re continuously refined based on performance feedback. It looks a lot like the (maybe more familiar) Plan-Do-Check-Act cycle. Let’s translate the FP&A Circle to the PDCA cycle.

Plan (Strategic Financial Planning)

Same as the PDCA cycle the FP&A Circle starts setting financial objects and building budgets and forecasts.

Do (Excuction & Allocation)

In this phase, you are putting the financial plan into action. It involves: Allocating resources (capital, manpower, technology) based on the budget. Executing financial strategies to achieve the set goals. For example: Create a specific budget for marketing campaigns for a new customer group. Monitoring cash flows and ensuring there is enough cash at hand.

Check (Performance Monitoring & Variance Analysis)

The check part of the FP&A Circle involves: Continuously monitor financial performance against set benchmarks, like your budget. Do a regular variance analysis where you analyse the differences between your budget and your actual results. Regularly check key financial metrics to evaluate the health of your organisation

Act (Adjustments & Optimisation)

In this phase, you are going to refine your strategies. Adjusting financial strategies based on performance feedback. Identifying areas of improvement and optimising resource allocation. Revising forecasts based on new data or changing market conditions.

Second, why would you implement an FP&A cycle into your startup?

Strategic Alignment:FP&A aligns financial actions with the strategic goals of an organisation. At the same time, it’s a mirror that shows if you are on the right path to achieving your goals and it’s a guide helping you to steer you in the right direction for achieving your goals.

Risk Mitigation:It helps you identify risks early and gives you the time to mitigate them. For instance, if you’re in a SaaS business, even something as operational as changing billing cycles can have significant cash flow risks that need careful consideration and planning. Here’s a detailed look at such risks and some strategies to mitigate them

Performance Optimisation: By constantly looking at performance and analysing both financial and non-financial results, FP&A enables startups to refine their strategies, tweak their operational efficiency, and maximise their performance.

Conclusion

FP&A is more than just a corporate tool; it's essential for startups. Using the FP&A Circle helps startups align their financial plans with their goals and adapt to changes. It's about strategy, managing risks, and improving performance. As we dive deeper into this series, we'll explore each part of FP&A, giving startups a clear guide on its importance and application.