21 September, 2023

The Hidden Risks of Billing Flexibility in SaaS

Jeroen

Founder, Startup Finance

Why Changing Your Billing Cycle is More Than Just a Calendar Shift

Changing billing cycles seems like a pretty straightforward operational change. You just send an invoice every month instead of once a year. Although this may be true there are significant cash flow risks that you need to account for.

Monthly and Annual Billing Cycles

The two most common billing cycles are Annual billing and Monthly billing. Most companies will try to persuade you by opting for the annual billing cycle upfront.

This doesn’t only lock the user in for a year and mindlessly renews for an extra year but also brings cash in forward. That earlier received cash can be used to fund our growth without the help of external capital.

The other choice is a monthly billing cycle often a bit more expensive but gives the user a lot more flexibility and doesn’t hurt the customers’s cash balance too much.

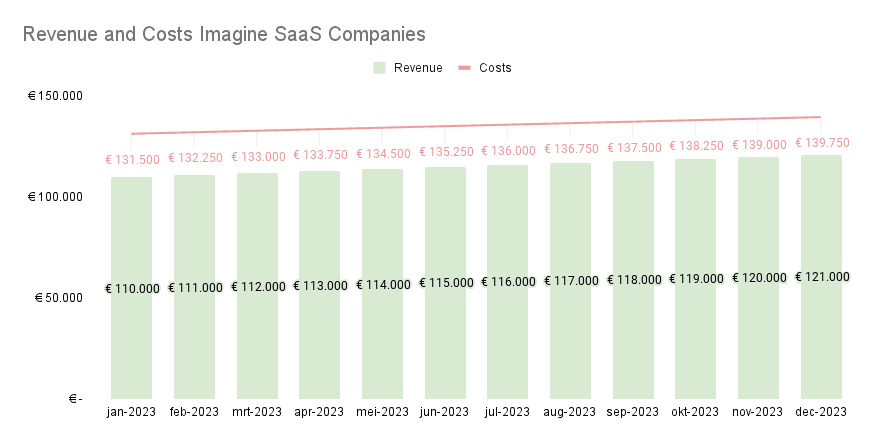

Let’s compare two identical SaaS companies with different billing cycles. They have the same P&L and cash balance at the beginning of the period.

There are a couple of assumptions that we are doing here:

EBITDA equals Cash out.

Invoices are paid in the same month.

Every month you close one customer for € 1.000 MRR.

Both companies have declining losses.

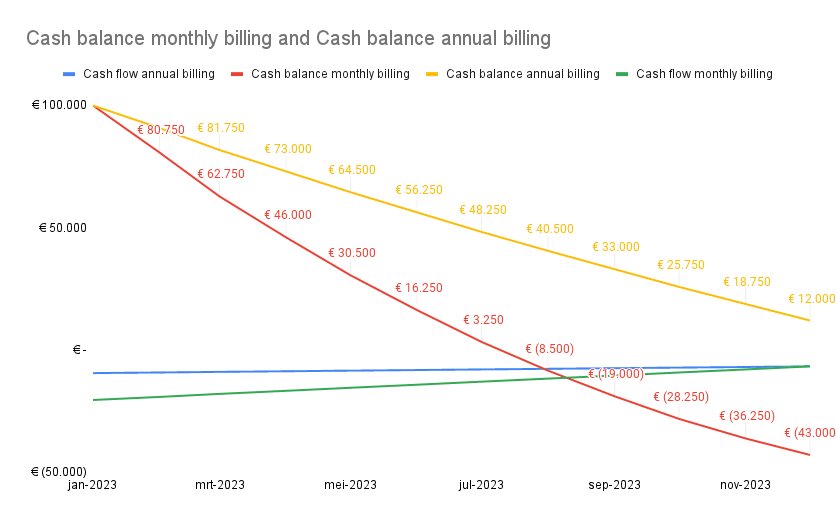

The chart above shows that the company with the monthly billing cycle is running out of cash in August while the company with the annual billing has € 12.000 left in December.

What if Customers Demand a Change in Their Billing Cycle?

The real challenge is when customers want to switch from a yearly billing cycle to a monthly billing cycle. Let’s break down the risks:

Reduced cash upfront impacts working capital As we saw in the example above billing annually will give you a lot of cash upfront. While monthly billing spreads this out over 12 months. This limits the working capital and makes it more difficult to invest in growth activities.

Increased operation costs: Monthly billing requires more invoices, payment processing and collections which can increase administrative costs.

Less predictable financial planning: Monthly subscriptions make it easier for customers to cancel which could lead to higher churn rates and therefore less predictable revenue. This leads to challenges with your budgeting process. With less stable revenue, it becomes difficult to allocate resources for long-term projects and investments.

How to Mitigate the Risk of a Cash Squeeze When Changing Billing Cycles?

There are a couple of ways to mitigate the risks when customers demand to switch to monthly billing. Assuming you don’t want to lose the customers.

Offer discounts for upfront payments: With the right discount, your customer may be persuaded to opt for a longer billing cycle. Such as quarterly or semi-annual.

Flexible payment terms with suppliers: If you can negotiate longer payment terms with your suppliers you can better match your cash out and inflows.

Credit line: It may be possible to get a credit line at your bank which you can use for more cash-tight months.

Revenue-based financing: This type of loan aligns repayments with your monthly revenue, offering flexibility during lean periods.

Cost optimisation and cash reserves: Take a good look at your current cost level and build a cash reserve big enough to cover the initial dip in cash inflows.

Revenue diversification: Introduce additional revenue streams, such as one-time fees for onboarding training or premium features.

Financial Planning: Make rolling forecasts and run scenarios about changing billing cycles to understand how changes in revenue or expenses could impact cash flow.

Conclusion

In conclusion, changing billing cycles in a SaaS business is not a decision to be taken lightly. It requires careful planning and communication to mitigate the impact of a potential cash squeeze. By understanding the financial implications and adopting proactive strategies, companies can navigate this challenging period successfully.